It is very important to comprehend that teen vehicle insurance is different from cars and truck insurance for young chauffeurs. Teenager car insurance coverage is for the teens that are legally eligible to drive; drivers in between 16 years and 19 years of ages (cheapest auto insurance). While young drivers are the ones between 21 years and also 25 years of age.

Some nationwide insurance policy firms still take into consideration teenager motorists and young vehicle drivers the very same - insurance company. It can be a bit pricey for young motorists as well as a little bit budget-friendly for teen drivers. It is constantly much better to make it clear with your service provider. Prior to getting your plan, ask the insurance provider regarding teen motorists as well as young motorists.

The area where the vehicle driver lives play a significant function in the vehicle insurance policy price. A driver living in Hawaii may get reduced insurance coverage prices as contrasted to a chauffeur in California.

These aspects include the condition of the roadway, the climate type, as well as the criminal activity price of the state. Continue reading The firm after that analyses all these variables and afterwards chooses what the insurance coverage rate will certainly be for the driver., if a state has high criminal activity prices after that the opportunities of vehicle stealing are greater.

Fascination About (Bitter) Sweet 16: Car Insurance For Teenagers

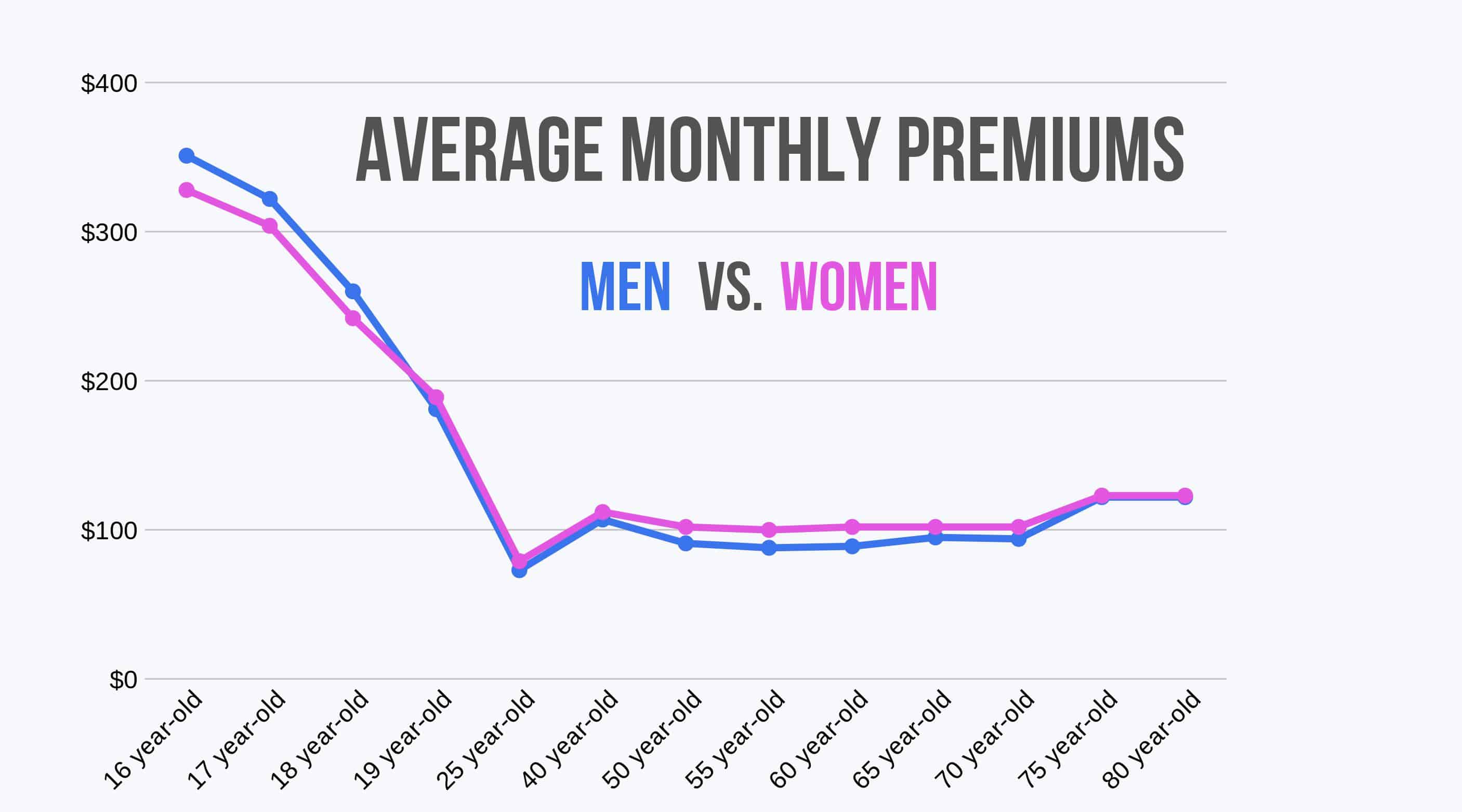

The gender of the vehicle driver influences a whole lot on the vehicle insurance price for any type of state, city, or area. Generally, we can claim that a male teen vehicle driver needs to pay $380 added as contrasted to a women teen motorist. Based on the insurance service providers around the nation, have much clean document and also absolutely no to one at-fault crash on record - insurance companies.

Plus they have a tendency to go across the rate limit a lot more as compared to women vehicle drivers. Because of this, insurance coverage companies discover female drivers much more secure consumers than male vehicle drivers. On standard, the female teen vehicle driver pays $3180 for minimal coverage, while a male chauffeur pays $3975 for minimum protection. Let's see the break down of this to have a clear photo.

As well as this is a lot reduced than the average insurance policy expense for a male teen motorist. The factor behind this is; as per insurance carriers around the nation, female vehicle drivers are much more secure as contrasted to male chauffeurs.

Get as many discounts as possible The most effective part of getting teen cars and truck insurance policy is you can look for a student discount rate. Every firm has its conditions for pupil discount rates (liability). Yet typically, the motorist needs to contend least a standard of B quality or greater to get certified.

Things about (Bitter) Sweet 16: Car Insurance For Teenagers

And after that you just need to compare the prices from all these firms to check which one has the most affordable prices (cars). By integrating the prices you'll obtain a better idea of exactly how different companies charge for the exact same policy. Yes, each firm can have a various rate for the same motorist.

money insurers insurance laws

money insurers insurance laws

Insurer connect the auto to either a beacon-like device or an app. This aids them to save the relevant to the driving habits. Based on this data the insurance service provider can supply you a personalized insurance policy rate. However it is essential to keep in mind that if the business discovers that your driving behaviors threaten then the prices can also raise.

4. Include a teen motorist to the moms and dad's plan The most effective method to obtain the most affordable auto insurance coverage for new vehicle drivers is to include them to their moms and dad's policy. There are some impressive advantages of remaining in your moms and dad's plan. The majority of the time; the parents have developed credit rating.

Plus you'll also get various other price cuts like numerous vehicles discounts and also even good and knowledgeable chauffeur discounts. Incorporating all these discount rates your insurance coverage prices can get decreased to nearly 60 percent of your existing prices. In addition, if the parents have paid for the automobile after that it is mandatory to get an insurance coverage plan under the parent's name (credit).

Not known Details About Teen Drivers - Auto Insurance - Illinois.gov

risks cheap insurance cheapest car insurance

risks cheap insurance cheapest car insurance

They have no other choice than to include their policy under their parent's existing plan. 5. Prevent high-value vehicles for the teenager drivers Yes, we understand your teen child is requesting that high valued luxury vehicle. The insurance coverage rate for that car can virtually be dual that of any kind of low-valued vehicle.

Again this can influence your insurance policy prices. The actual cost worth of that car will certainly be low hence your insurance coverage business will provide lower insurance coverage rates for the cars and truck. Can my teen drive my automobile if he or she is not noted on the policy?

suvs vans low cost dui

suvs vans low cost dui

Do teenagers require to get full protection auto insurance coverage? No, teen motorists can drive legitimately with the state's minimum called for coverage. Complete coverage insurance coverage is recommended for teens to avoid massive fixing expenses.

The factor behind this is; as per the insurance policy firms around the country, teenager drivers have the greatest involvement in significant road crashes. Which is the ideal business to acquire vehicle insurance coverage for 17 years old?

What Does How Much Is Car Insurance For A 16-year-old? - Wallethub Do?

The top five automobile insurance coverage companies for teen chauffeurs are; Allstate, Progressive, Erie, Nationwide, as well as USAA. Is it far better to include the teen drivers to the moms and dad's plan? Adding a teen chauffeur to a parent's plan can be a clever choice.

Still, have some uncertainties concerning purchasing automobile insurance policy for teenager vehicle drivers?

liability cheapest car cheaper cars cheapest

liability cheapest car cheaper cars cheapest

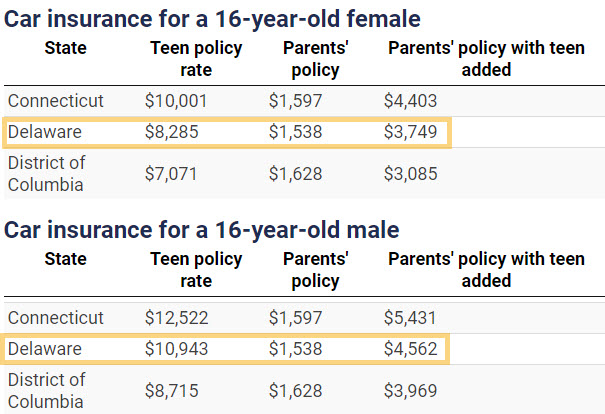

Understanding how to drive as well as obtaining your very first motorist's license is a special celebration. auto. What's much less enjoyable is the insurance policy costs that adheres to. As a result of lack of experience when driving, teenagers and young vehicle drivers are often extra accident-prone and also therefore extra costly to guarantee. On standard, parents can expect to see their yearly insurance policy bill rise by $2,531 when including a 16-year-old chauffeur to their complete coverage car insurance coverage policy, according to Bankrate.

Prior to we dive in, below are some points to bear in mind. What to learn about insuring teenagers and also young motorists, Teenager motorists are those in the 16 to 19 age range, while young person vehicle drivers are in between 20 and also 25. One of the most expensive age to guarantee are 16-year-olds.

Unknown Facts About How Much Does Car Insurance Cost For A 16-year-old?

If you're a parent, once your child gets to 18, you'll require to make a decision whether to acquire a different cars and truck insurance coverage for your teen or have them noted on your insurance coverage."It is virtually never more economical to have actually teens listed under their own insurance policy," stated Michael Giusti, an analyst at .

Exactly how do you save money on auto insurance policy for teens? There are ways to reduce down on insurance coverage premium plan expenses.

Power. The carrier obtained an overall score of 884 as well as 909 in general customer contentment and also vehicle claims fulfillment, specifically. In comparison, the national averages are appeared at 834 and also 909, additionally specifically. Too, USAA provides affordable pricing for those that qualify compared to other insurance firms-- and taking advantage of price cuts makes the rates much more competitive.

One important point to note with State Ranch is that the carrier obtains even more than 1., even though they have high customer satisfaction scores according to J.D. Power. That's larger than the Twitter complying with for Geico's unnamed gecko.

Unknown Facts About How Much Does It Cost To Add A Teenager To Car Insurance?

The NAIC's index racked up Progressive at 1. 05 out of 1. 00 (above one implies more complaints). Additionally, the typical annual additional premium for full protection for a 16-year-old is $2,085, which is reduced than the nationwide average. Progressive has a collection of discount rates for family members with several cars as well as for both teen drivers as well as college pupils.

Amica made it on our ideal cars and truck insurance coverage listing due to its high customer fulfillment ratings and also that's one of the factors it additionally makes this list - laws. As the oldest mutual cars and truck insurance firm in the US (indicating it's owned by its policyholders), Amica has over a century of industry know-how under its belt.

Together with conventional offerings for young chauffeurs-- including "great pupil" discounts, "student away at school" discounts and defensive driver training program price cuts-- Amica supplies a distinct method to save: a heritage discount. This price cut will get young chauffeurs under 30 whose moms and dads have had an auto policy with Amica for at the very least five years - insurance companies.

Each carrier manages accident forgiveness in a different way, and also so while some providers might give you this function as a free incentive, others may make it an add-on to your policy you need to pay for. Crash mercy may not be available in all states, however that depends on the carrier, also.

Little Known Facts About How To Save Money On Teen Car Insurance - Ramsey Solutions.

It is not available in Connecticut, Delaware, North Caroline, California or New York.: To get approved for State Ranch's accident mercy, you should have gone to State Ranch and have gone accident-free for 9 years.: This carrier uses 2 crash forgiveness options. "Small Mishap Forgiveness" comes with your policy, as well as it'll cover you if the overall case is less than or equal to $500.

laws automobile cheaper car insured car

laws automobile cheaper car insured car

It has actually not been supplied or commissioned by any third event. However, we may get compensation when you click web links to items or solutions offered by our companions.

Vehicle insurance coverage for 16-year-olds can be frightening to think of. Moms and dads and also guardians quickly believe of the cost, as well as exactly how overwhelming selecting the ideal insurance policy can be. According to the Centers for Illness Control and also Prevention, the risk of an auto accident is higher among 16- to 19-year olds than amongst any type of various other age.

The expense often tends to rise by a standard of $800 per year, current information recommends., what aspects impact insurance policy costs, as well as just how to conserve on insurance prices.

An Unbiased View of Car Insurance Guide For California Teens - Driversed.com

The expense to add a teen onto an insurance coverage can be high because of absence of driving history as well as experience, but it additionally varies based upon numerous variables. Including teens to a parent's policy, sharing a car, as well as keeping excellent grades can all assist reduced automobile insurance policy costs for young people.

Typically speaking, automobile insurance policy instantly expands to young chauffeurs. Some insurance service providers are more stringent. To know what your insurance service provider calls for, call as well as talk with your cars and truck insurance agent.